Why Tesla is Immune to the Chicken Tax

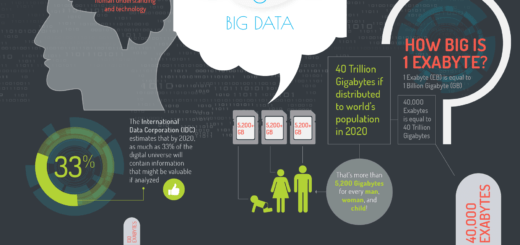

A simple tariff can have a big impact on how an industry functions. The way that the chicken tax has shaped the American automotive industry is a prime example. It has determined which vehicles have made it to the American market for decades, and now it may be the factor that pushes Tesla’s new truck toward success.

What is the Chicken Tax?

If it seems hard to see a connection between chickens and trucks, that is because the link between chickens and trucks is purely political. The chicken tax dates back to the Johnson administration, which established the tariff in 1964. France and Germany had placed tariffs on American chicken, and the American government responded by putting tariffs on several of their products. Most of those tariffs have long since been repealed, but a 25% tariff on light trucks remains in place as a relic of the trade war.

Native Companies Avoid the Tax

Strictly speaking, the chicken tax is a tariff rather than a traditional tax. The government only charges it on the import of foreign trucks. Domestic automotive companies can avoid paying it as long as they build their vehicles in the United States. That rule has lead to some interesting tricks to avoid paying, such as importing kits and assembling them in an American facility. It has also spared American truck companies from foreign competition.

Tesla is Changing the Market

The general lack of competition led to stagnation in the American truck market. After all, the automotive companies had no need to innovate in order to beat the competition. Tesla is changing that. Their vehicles need to innovate in order to overcome the entrenched brands and encourage people to take the plunge on new technology.

They will be bringing new products into an industry that is used to dealing with a calm, steady system. That gives them an advantage over the other companies, who might be in for a surprise in the near future.

Recent Comments